Global FinTech Report

Blurred lines: How FinTech is shaping Financial Services

Blurred lines: How FinTech is shaping Financial Services Global FinTech Report March 2016 20% 57% More than 20% of are unsure about or FS business is at risk unlikely to respond to to FinTechs by 2020 blockchain technology pwc.com/fintechreport

2 PwC 2 PwC Global FinTGlobal FinTech Reportech Report Contents Title Key messages Introduction 3 Section 1: The epicentre of disruption 5 Section 2: Emerging FinTech trends on the radar 9 Section 3: An industry under siege 19 Section 4: ffence is the est defence 22 oncusion 29 Appendi 3 FinTech is shaping FS Where traditional Disintermediation: Time to get off the from the outside in financial institutions FinTech’s most bench: over 20% Summaries of the trends 31 have failed, FinTechs powerful weapon of FS business at risk eo€o 34 are succeeding to FinTechs ontacts 35 Blockchain: an Heading for bargain The free lunch is over: untapped technology basement FS? FinTech FS must leverage the is rewriting the is slashing costs FinTech ecosystem FS rulebook

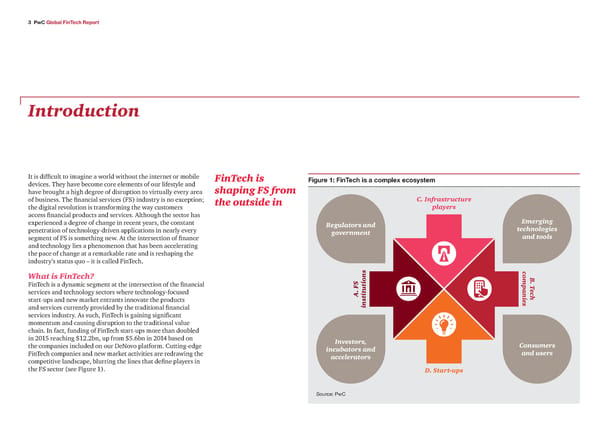

3 PwC Global FinTech Report Introduction It is difficult to imagine a world without the internet or mobile FinTech is Figure 1: FinTech is a comple ecosstem devices. They have become core elements of our lifestyle and shaping FS from have brought a high degree of disruption to virtually every area of business. The financial services (FS) industry is no exception; the outside in C. Infrastructure the digital revolution is transforming the way customers players access financial products and services. Although the sector has experienced a degree of change in recent years, the constant Regulators and Emerging penetration of technology-driven applications in nearly every government technologies segment of FS is something new. At the intersection of finance and tools and technology lies a phenomenon that has been accelerating the pace of change at a remarkable rate and is reshaping the industry’s status quo – it is called FinTech. What is FinTech? comB. T FinTech is a dynamic segment at the intersection of the financial . FS paniesech services and technology sectors where technology-focused A titutions start-ups and new market entrants innovate the products ins and services currently provided by the traditional financial services industry. As such, FinTech is gaining significant momentum and causing disruption to the traditional value chain. In fact, funding of FinTech start-ups more than doubled in 2015 reaching $12.2bn, up from $5.6bn in 2014 based on Investors, the companies included on our DeNovo platform. Cutting-edge incubators and Consumers FinTech companies and new market activities are redrawing the accelerators and users competitive landscape, blurring the lines that define players in the FS sector (see Figure 1). D. Start-ups Source: ‚ƒ

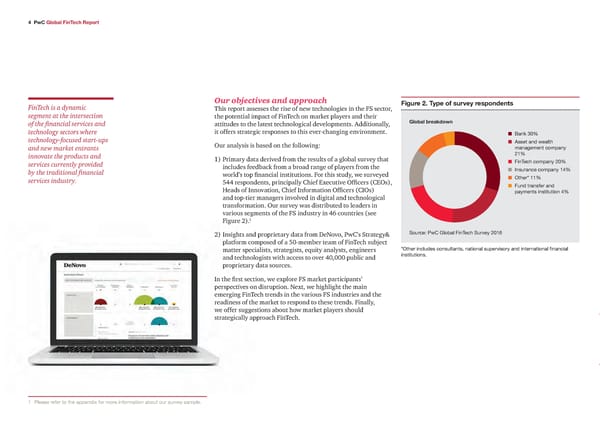

PwC Global FinTech Report Our objectives and approach Figure 2 Tpe o sure respon ents FinTech is a dynamic This report assesses the rise of new technologies in the FS sector, segment at the intersection the potential impact of FinTech on market players and their of the financial services and attitudes to the latest technological developments. Additionally, Global brea own technology sectors where it offers strategic responses to this ever-changing environment. n ‡anˆ 3‰ technology-focused start-ups Our analysis is based on the following: n Asset and ƒeath and new market entrants management company innovate the products and 21‰ services currently provided 1) Primary data derived from the results of a global survey that n FinTech company 2‰ by the traditional financial includes feedback from a broad range of players from the n Insurance company 14‰ services industry. world’s top financial institutions. For this study, we surveyed n therŠ 11‰ 544 respondents, principally Chief Executive Officers (CEOs), n Fund transfer and Heads of Innovation, Chief Information Officers (CIOs) payments institution 4‰ and top-tier managers involved in digital and technological transformation. Our survey was distributed to leaders in various segments of the FS industry in 46 countries (see 1 Figure 2). 2) Insights and proprietary data from DeNovo, PwC’s Strategy& Source: ‚ƒ …oa FinTech Sur€ey 21† platform composed of a 50-member team of FinTech subject matter specialists, strategists, equity analysts, engineers Šther incudes consutants‹ nationa super€isory and internationa financia and technologists with access to over 40,000 public and institutions„ proprietary data sources. In the first section, we explore FS market participants’ perspectives on disruption. Next, we highlight the main emerging FinTech trends in the various FS industries and the readiness of the market to respond to these trends. Finally, we offer suggestions about how market players should strategically approach FinTech. 1 ‚ease refer to the appendi for more information aout our sur€ey sampe„

€ PwC Global FinTech Report The epicentre of disruption 1 New digital technologies are in the process of reshaping the value proposition of existing financial products and services. While we should not underestimate the capacity of incumbents to assimilate innovative ideas, the disruption of the financial sector is clearly underway. And consumer banking and payments, already on the disruption radar, will be the most exposed in the near future, followed by insurance and asset management. “We thought we knew our customers, but FinTechs really know our customers.” Up to 28% Banking A senior executive at a global banking organisation. of business and at risk by Payments 2020 Up to 22% Insurance, of business Asset Management at risk by and Wealth 2020 Management

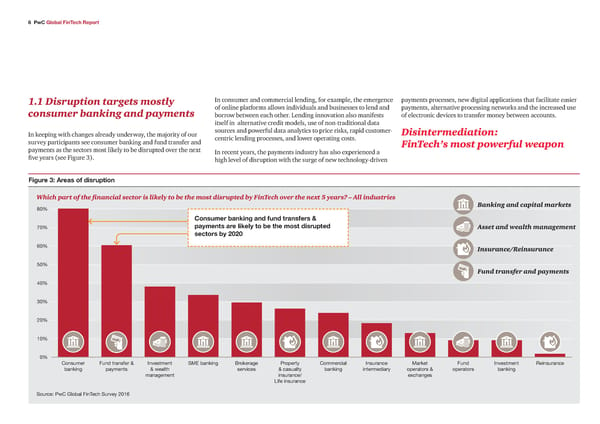

6 PwC Global FinTech Report 1.1 Disruption targets mostly In consumer and commercial lending, for example, the emergence payments processes, new digital applications that facilitate easier consumer banking and payments of online platforms allows individuals and businesses to lend and payments, alternative processing networks and the increased use borrow between each other. Lending innovation also manifests of electronic devices to transfer money between accounts. itself in alternative credit models, use of non-traditional data In keeping with changes already underway, the majority of our sources and powerful data analytics to price risks, rapid customer- Disintermediation: survey participants see consumer banking and fund transfer and centric lending processes, and lower operating costs. FinTech’s most powerful weapon payments as the sectors most likely to be disrupted over the next In recent years, the payments industry has also experienced a five years (see Figure 3). high level of disruption with the surge of new technology-driven Figure 3: ‚reas o isruption Which part of the financial sector is likely to be the most disrupted by FinTech over the next 5 years? – All industries •‰ Banking and capital markets Consumer baning an un transers ƒ –‰ paments are liel to be the most isrupte Asset and wealth management sectors b 2020 †‰ Insurance/Reinsurance 5‰ Fund transfer and payments 4‰ 3‰ 2‰ 1‰ ‰ onsumer Fund transfer Ž In€estment S‘E anˆing ‡roˆerage ‚roperty ommercia Insurance ‘arˆet Fund In€estment ”einsurance anˆing payments Ž ƒeath ser€ices Ž casuaty anˆing intermediary operators Ž operators anˆing management insurance’ echanges “ife insurance Source: ‚ƒ …oa FinTech Sur€ey 21†

„ PwC Global FinTech Report 1.2 Asset management and insurance Figure : ‚reas o …isruption – ‡ncumbents’ iews s outsi ers’ opinions are also on the disruption radar Although a high level of disruption triggered by FinTech is already beginning to reshape the nature of lending and payment practices, a second wave of disruption is making inroads in the asset management and insurance sectors. Our survey found that this perception is confirmed by insiders. Nearly half of insurers and asset and wealth managers consider their respective industries to be the most disrupted. When asked which part of the FS sector is the most likely to be disrupted by FinTech over the next 5 years, 74% of insurance companies identified their own industry, while only 26% of players from other sectors agreed; 51% of asset Asset & managers said their industry will be disrupted, while only 31% of wealth other players agreed. However, there seems to be a perception gap Insurance Other management Other here; professionals from other industries do not see the same level companies respondents companies respondents of disruption in these areas. The fact that only insiders are aware of this situation, while outsiders don’t perceive it could indicate 74% 26% 51% 31% that the disruption is in its very early stages (see Figure 4). Even so, venture capitalists are looking very closely at start-ups dedicated to reinventing the way we invest money and buy insurance. Insurance In€estment Ž —eath ‘anagement Annual investments in InsurTech start-ups has increased fivefold over the past three years, with cumulative funding of InsurTechs Source: ‚ƒ …oa FinTech Sur€ey 21† reaching $3.4bn since 2010, based on companies followed in our DeNovo platform. The pace of change in the global insurance industry is accelerating more quickly than could have been envisaged. The industry is at a pivotal juncture as it grapples with changing customer behaviour, new technologies and new distribution and business models. The investment industry is also being pulled into the vortex of vast technological developments. The emergence of data analytics in the investment space has enabled firms to hone in on investors and deliver tailored products and automated investing. Additionally, innovations in lending and equity crowdfunding are providing access to asset classes formerly unavailable to individual investors, such as commercial real estate.

‰ PwC Global FinTech Report 1.3 Customer centricity is Where Figure €: Šusiness challenges fuelling disruption traditional Financial In which areas do you see the most important impact to your business from FinTech? As clients are becoming accustomed to the digital experience Institutions have offered by companies such as Google, Amazon, Facebook and Apple, they expect the same level of customer experience from failed, FinTechs their financial services providers. FinTech is riding the waves of are succeeding Meet changing disruption with solutions that can better address customer needs 75% customer needs by offering enhanced accessibility, convenience and tailored with new offerings products. In this context, the pursuit of customer centricity has become a main priority and it will help to meet the needs of digital native clientele. 51% Leverage existing Over the next decade, the average FS consumer profile will data and analytics change dramatically as the Baby Boomer generation ages and Generations X and Y assume more significant roles in the global economy. The latter group, also known as “Millennials” (those born between 1980 and 2000), is bringing radical shifts to client Enhance interactions demographics, behaviours and expectations. Its preference for 42% and build trusted a state-of-the-art customer experience, speed and convenience relationships will further accelerate the adoption of FinTech solutions. Millennials seem to be bringing a higher degree of customer centricity to the entire financial system, a shift that is being Enhance business crystallised in the DNA of FinTech companies. While 53% of 42% with sophisticated financial institutions believe that they are fully customer-centric, operational capabilities this share exceeds 80% for FinTech respondents. In this respect, 75% of our respondents confirmed that the most important impact FinTech will have on their businesses is an increased Source: ‚ƒ …oa FinTech Sur€ey 21† focus on the customer (see Figure 5).

‹ PwC Global FinTech Report Emerging FinTech trends on the radar 2 To help industry players navigate the changes in the banking, The methodology is based on DeNovo’s insights of fund transfer and payments, insurance, and asset and wealth emerging FinTech trends for each financial segment management sectors, we have identified the main emerging (see Summaries of trends in the Appendix). Industry trends that will be most significant in the next five years in each leaders assessed which trends in their segment will be area of the FS industry. important for their business over the next five years and Overall, the key trends will enhance customer experience, indicated their likelihood to respond to each of them. self-directed services, sophisticated data analytics and The trends in the upper right quadrant of the chart reflect cybersecurity. However, the focus will differ from one FS those that Financial institutions are prioritising for each segment to another. FS sector. For each segment, a bubble chart benchmarks the trends Asset & wealth Banking according to three indicators. The vertical axis of the management graph displays the level of importance. On the horizontal axis, the likelihood to respond to these trends (e.g. allocate resources, invest) is given, and the size of the bubbles is proportional to the number of related FinTech companies associated with the trend (see Figures 6, 7, 8 and 9). Fund transfer Insurance & payments

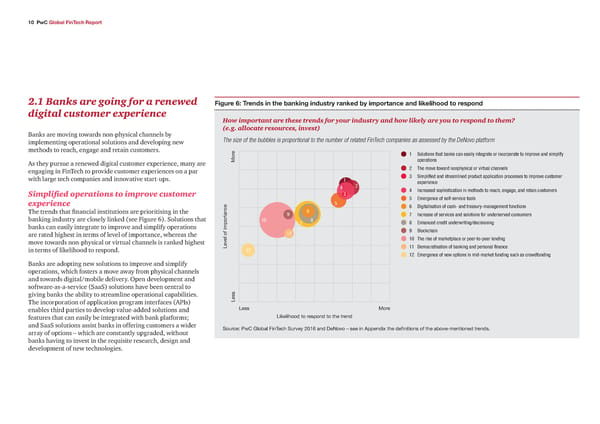

10 PwC Global FinTech Report 2.1 Banks are going for a renewed Figure 6: Tren s in the baning in ustr rane b importance an lielihoo to respon digital customer experience How important are these trends for your industry and how likely are you to respond to them? (e.g. allocate resources, invest) Banks are moving towards non-physical channels by The size of the bubbles is proportional to the number of related FinTech companies as assessed by the DeNovo platform implementing operational solutions and developing new methods to reach, engage and retain customers. e 1 Solutions that banks can easily integrate or incorporate to improve and simplify As they pursue a renewed digital customer experience, many are ‘or operations engaging in FinTech to provide customer experiences on a par 2 The move toward nonphysical or virtual channels with large tech companies and innovative start-ups. 1 Simplified and streamlined product application processes to improve customer 2 eperience Increased sophistication in methods to reach engage and retain customers Simplified operations to improve customer mergence of selfservice tools experience € ‚igitalisation of cash and treasurymanagement functions The trends that financial institutions are prioritising in the † € ƒ Increase of services and solutions for underserved consumers banking industry are closely linked (see Figure 6). Solutions that 1ˆ ƒ „ „ nhanced credit underwriting…decisioning banks can easily integrate to improve and simplify operations importance † ‡lockchain of 11 are rated highest in terms of level of importance, whereas the 1ˆ The rise of marketplace or peertopeer lending move towards non-physical or virtual channels is ranked highest “e€e 11 ‚emocratisation of banking and personal finance in terms of likelihood to respond. 12 12 mergence of new options in midmarket funding such as crowdfunding Banks are adopting new solutions to improve and simplify operations, which fosters a move away from physical channels and towards digital/mobile delivery. Open development and software-as-a-service (SaaS) solutions have been central to giving banks the ability to streamline operational capabilities. The incorporation of application program interfaces (APIs) “ess enables third parties to develop value-added solutions and “ess ‘ore features that can easily be integrated with bank platforms; “iˆeihood to respond to the trend and SaaS solutions assist banks in offering customers a wider Source: ‚ƒ …oa FinTech Sur€ey 21† and eo€o – see in Appendi the definitions of the ao€e™mentioned trends„ array of options – which are constantly upgraded, without banks having to invest in the requisite research, design and development of new technologies.

11 PwC Global FinTech Report The move towards virtual banking solutions is being driven, in Figure „: Tren s in the un transer an paments in ustr rane b importance an lielihoo to respon large part, by consumer expectations. While some segments still prefer human interactions in certain parts of the process, a How important are these trends for your industry and how likely are you to respond to them? viable digital approach is now mandatory for lenders wishing (e.g. allocate resources, invest) to compete across all consumer segments.2 Online banks rely on transparency, service quality and unlimited global access to The size of the bubbles is proportional to the number of related FinTech companies as assessed by the DeNovo platform attract Millennials, who are willing to access multiple service channels. In addition, new players in the banking market offer e 1 Advanced tools and technology to protect consumers from identity theft fraudulent ease of use in product design and prioritise 24/7 customer ‘or transactions and account falsification service, often provided through non-traditional methods such as 2 Increased push for faster payments social media. 1 ‰ise of digital wallet adoption ‰ise of net generation pointofsale solutions So what? – Put the customer at the centre Šroliferation of international…crossborder transfer platforms of operations † 2 € Alternative retailpayment networks and fundtransfer solutions € Traditional banks may already have many of the streamlined ƒ „ ƒ Increased adoption of contactless technology for digital wallets and digital/mobile-first capabilities, but they should look to „ Simplification of onlinecheckout eperience integrate their multiple digital channels into an omni-channel importance 1ˆ † ‰ise of peertopeer payment solutions customer experience and leverage their existing customer 1ˆ Increased valueadded merchant service offerings of relationships and scale. Banks can organise around customers, 11 11 ‡lockchain rather than a single product or channel, and refine their “e€e approach to provide holistic solutions by tailoring their offerings to customer expectations. These efforts can also be supported by using newfound digital channels to collect data from customers to help them better predict their needs, offer compelling value propositions, and generate new revenue streams. “ess 2.2 Fund transfer and payments “ess ‘ore priorities are security and “iˆeihood to respond to the trend increased ease of payment Source: ‚ƒ …oa FinTech Sur€ey 21† and eo€o – see in Appendi the definitions of the ao€e™mentioned trends„ Our survey shows that the major trends for fund transfer and payments companies are related to both increased ease and security of payments (see Figure 7). 2 ‚ƒ‹ onsumer ending: understanding today’s empoƒered orroƒers‹ 215

12 PwC Global FinTech Report Safe and fast payments are emerging trends 2.3 Asset and wealth management Mobile smartphone adoption is one of the drivers of changing shifts from technology-enabled payments patterns. Today’s mobile-first consumers expect immediacy, convenience and security to be integral to payments. human advice to human-supported In our culture of on-demand streaming of digital products and technology-driven advice services, archaic payment solutions that take days rather than seconds for settlement are considered unacceptable, motivating both incumbents and newcomers to develop solutions that Figure 8 clearly demonstrates that the main trend the asset enable transfer of funds globally in real-time. End users also and wealth management industry is focusing on at present is the expect a consistent omni-channel experience in banking and increased sophistication of data analytics to better identify and payments, making digital wallets key to streamlining the user quantify risk. experience and enabling reduced friction at the checkout. Finally, end users expect all of this to be safe. Security and More sophisticated data analytics as a Mobile smartphone privacy are paramount to galvanising support for nascent forms gateway for emerging trends adoption is one of the drivers of digital transactions, and solutions that leverage biometrics The proliferation of data, along with new methods to capture it for fast and robust authentication coupled with obfuscation and the declining cost of doing so, is reshaping the investment of changing payments technologies, such as tokenisation, are critical components in patterns. Today’s mobile-first creating an environment of trust for new payment paradigms. landscape. New uses of data analytics span the spectrum from consumers expect immediacy, institutional trading and risk management to small notional convenience and security to So what? – Speed up, but in a secure way retail wealth management. The increased sophistication of data be integral to payments. Speed, security and digitisation will be growing trends for the analytics is reducing the asymmetry of information between payments ecosystem. In an environment where traditional small- and large-scale financial institutions and investors, loyalty to financial institutions is being diminished and barriers with the latter taking advantage of automated FS solutions. to entry from third parties are lowered, the competitive Sophisticated analytics also uses advanced trading and risk landscape is fluid and potentially changeable, as newcomers like management approaches such as behavioural and predictive Apple Pay, Venmo and Dwolla have demonstrated. Incumbents algorithms, enabling the analysis of all transactions in real time. that are slow to adapt to change could well find themselves Wealth managers are increasingly using analytics solutions losing market share to companies that may not have a traditional at every stage of the customer relationship to increase client payments pedigree, but that have a critical mass of users and the retention and reduce operational costs. By incorporating network connectivity to enable payment experiences that are broader and multi-source data sets, they are forming a more considered at least equivalent to the status quo. While most of holistic view of customers to better anticipate and satisfy their these solutions “ride the rails” of traditional banking, in doing so needs. they risk losing control of the customer experience and ceding ground to innovators, or “steers”, who conduct transactions as they see fit.

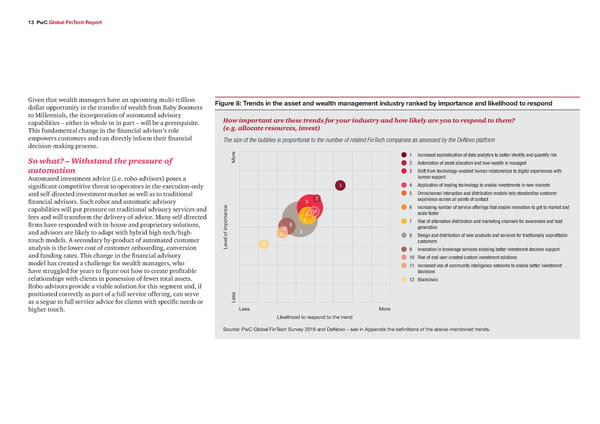

13 PwC Global FinTech Report Given that wealth managers have an upcoming multi-trillion- Figure ‰: Tren s in the asset an wealth management in ustr rane b importance an lielihoo to respon dollar opportunity in the transfer of wealth from Baby Boomers to Millennials, the incorporation of automated advisory How important are these trends for your industry and how likely are you to respond to them? capabilities – either in whole or in part – will be a prerequisite. (e.g. allocate resources, invest) This fundamental change in the financial advisor’s role empowers customers and can directly inform their financial The size of the bubbles is proportional to the number of related FinTech companies as assessed by the DeNovo platform decision-making process. e 1 Increased sophistication of data analytics to better identify and ‹uantify risk So what? – Withstand the pressure of ‘or 2 Automation of asset allocation and how wealth is managed automation Shift from technologyenabled human relationships to digital eperiences with Automated investment advice (i.e. robo-advisors) poses a human support significant competitive threat to operators in the execution-only 1 Application of leading technology to enable investments in new markets and self-directed investment market as well as to traditional Omnichannel interaction and distribution models help standardise customer financial advisors. Such robot and automatic advisory 2 eperience across all points of contact capabilities will put pressure on traditional advisory services and € Increasing number of service offerings that enable innovation to get to market and fees and will transform the delivery of advice. Many self-directed € scale faster ƒ ƒ ‰ise of alternative distribution and marketing channels for awareness and lead firms have responded with in-house and proprietary solutions, importance † generation and advisors are likely to adapt with hybrid high-tech/high- 1ˆ „ of 11 „ ‚esign and distribution of new products and services for traditionally unprofitable touch models. A secondary by-product of automated customer 12 customers analysis is the lower cost of customer onboarding, conversion “e€e † Innovation in brokerage services enabling better investment decision support and funding rates. This change in the financial advisory 1ˆ ‰ise of end usercreated custom investment solutions model has created a challenge for wealth managers, who 11 Increased use of community intelligence networks to enable better investment have struggled for years to figure out how to create profitable decisions relationships with clients in possession of fewer total assets. 12 ‡lockchain Robo-advisors provide a viable solution for this segment and, if positioned correctly as part of a full service offering, can serve as a segue to full service advice for clients with specific needs or “ess higher touch. “ess ‘ore “iˆeihood to respond to the trend Source: ‚ƒ …oa FinTech Sur€ey 21† and eo€o – see in Appendi the definitions of the ao€e™mentioned trends„

1 PwC Global FinTech Report Figure ‹: Tren s in the insurance in ustr rane b importance an lielihoo to respon 2.4 Insurers leverage data and analytics to bring personalised How important are these trends for your industry and how likely are you to respond to them? value propositions while (e.g. allocate resources, invest) The size of the bubbles is proportional to the number of related FinTech companies as assessed by the DeNovo platform proactively managing risk e 1 Selfdirected services ‘or 2 Œsagebased Insurance Žpay as you go‘ The insurance sector sees usage-based risk models and new ‰emote access and data capture methods for capturing risk-related data as key trends, while the shift to more self-directed services remains a top priority in ’onnected…smart car order to efficiently meet existing customer expectations. 2 1 “ew models of holistic advice Žroboadvice‘ € ”ranular risk and…or loss ‹uantification Increasing self-directed services for ƒ Shift from probabilistic to deterministic model insurance clients „ ’onnected health & medical advances „ ƒ € Our survey shows that self-directed services are the most † ‰idesharing solutions important trend and the one to which the market is by importance † 1ˆ ‰obotics and automation in core insurance 1ˆ far most likely to respond. As is the case in other industry of 11 ‡lockchain segments, insurance companies are investing in the design and “e€e implementation of more self-directed services for both customer acquisition and customer servicing. This allows companies to improve their operational efficiency while enabling online/ mobile channels demanded by emerging segments such as Millennials. There have been interesting cases where customer- 11 centric designs create compelling user experiences (e.g. quotes obtained by sending a quick picture of the driving licence and “ess the car vehicle identification number (VIN)), and where new “ess ‘ore solutions bring the opportunity to mobilise core processes in a “iˆeihood to respond to the trend matter of hours (e.g. provide access to services by using “robots” to create a mobile layer on top of legacy systems) or augment Source: ‚ƒ …oa FinTech Sur€ey 21† and eo€o – see in Appendi the definitions of the ao€e™mentioned trends„ current key processes (e.g. FNOL3 notification, which includes differentiated mobile experiences). 3 First otice of “oss

1€ PwC Global FinTech Report Usage-based insurance is becoming more So what? – Differentiate, personalise and relevant leverage new data sources Current trends also show an increasing interest in finding new Customers with new expectations and the need to build trusted underwriting approaches based on the generation of deep risk relationships are forcing incumbents to seek value propositions insights. In this respect, usage-based models – rated the second where experience, transaction efficiency and transparency most important trend by survey participants (see Figure 9) – are key elements. As self-directed solutions emerge among are becoming more relevant even as initial challenges such as competitors, the ability to differentiate will be a challenge. data privacy are being overcome. Auto insurance pay-as-you- drive is now the most popular usage-based insurance (UBI), Similarly, usage-based models are emerging in response to and the current focus is shifting from underwriting to the customer demands for personalised insurance solutions. customer. Initially, incumbents viewed UBI as an opportunity to The ability to access and capture remote risk data will help underwrite risk in a more granular way by using new driving/ to develop a more granular view of the risk, thus enabling behavioural variables, but new players see UBI as an opportunity personalisation. The telematics-based solution that enables to meet new customers’ needs (e.g. low mileage or sporadic pay-as-you-drive is one of the first models to emerge and is drivers). gaining momentum; new approaches are also emerging in the life insurance market where the use of wearables to monitor The telematics-based solution Data capture and analytics as an emerging the healthiness of lifestyles can bring rewards and/or premium that enables pay-as-you-drive trend discounts among other benefits. is one of the first models Remote access and data capture was ranked third by the survey Leveraging new data sources to obtain a more granular view to emerge and is gaining respondents according to the level of importance (see Figure 9). of the risk will not only offer a key competitive advantage momentum. Deep risk (and loss) insights can be generated from new data in a market where risk selection and pricing strategies can sources that can be accessed remotely and in real-time if needed. be augmented, but will also allow incumbents to explore This ability to capture huge amounts of data must be coupled unpenetrated segments. In this line, new players that have with the ability to analyse it to generate the required insights. generated deep risk insights are also expected to enter these This trend also includes the impact of the Internet of Things unpenetrated segments of the market; for example, life (IoT); for example, (1) drones offer the ability to access remote insurance for individuals with specific diseases. areas and assess loss by running advanced imagery analytics, and (2) integrated IoT platforms solutions include various Finally, we believe that, in addition to social changes, the driving types of sensors, such as telematics, wearables and those found force behind innovation in insurance can largely be attributed in industrial sites, connected homes or any other facilities/ to technological advances outside the insurance sector that will equipment. bring new opportunities to understand and manage the risk (e.g. telematics, wearables, connected homes, industrial sensors, medical advances, etc.), but will also have a direct impact on 4 and autonomous cars). some of the foundations (e.g. ADAS 4 Ad€anced ri€er Assistance Systems

16 PwC Global FinTech Report 2.5 Blockchain: an untapped Figure 10: Familiarit with blocchain technology is rewriting the FS rulebook Please describe the extent to which you are familiar with blockchain technology 4‰ Blockchain is a new technology that combines a number of 35‰ mathematical, cryptographic and economic principles in order to maintain a database between multiple participants without 3‰ the need for any third party validator or reconciliation. In simple terms, it is a secure and distributed ledger. Our insight is that blockchain represents the next evolutionary jump in business 25‰ process optimisation technology. Just as Enterprise Resource Planning (ERP) software allowed functions and entities within 2‰ a business to optimise business processes by sharing data and logic within the enterprise, blockchain will allow entire 15‰ industries to optimise business processes further by sharing data between businesses that have different or competing economic 1‰ objectives. That said, although the technology shows a lot of promise, several challenges and barriers to adoption remain. 5‰ Further, a deep understanding of blockchain and its commercial implications requires knowledge that intersects various ‰ disparate fields and this leads to some uncertainty regarding its ot at a famiiar Sighty famiiar ‘oderatey famiiar ›ery famiiar Etremey famiiar potential applications. tremely familiar• I feel as if I am epert on blockchain technology and how it works– Uncertain responses to the promises —ery familiar• I feel as if I have fairly complete knowledge of blockchain technology and how it works– of blockchain ˜oderately familiar• I have read or heard about blockchain technology in the news and have researched it to some degree– Compared to the other trends, blockchain ranks lower on the Slightly familiar• I have read or heard about blockchain technology in the news– agendas of survey participants. While a majority of respondents “ot at all familiar• I do not know about blockchain technology at all– (56%) recognise its importance, 57% say they are unsure or Source: ‚ƒ …oa FinTech Sur€ey 21† n A€erage a industries n Fund transfer Ž payments n ‡anˆs n A‘ Ž —‘ n Insurance unlikely to respond to this trend. This may be explained by the low level of familiarity with this new technology: 83% of respondents are at best “moderately” familiar with it and only very few consider themselves to be experts (see Figure 10). This lack of understanding may lead market participants to underestimate the potential impact of blockchain on their activities.

1„ PwC Global FinTech Report The greatest level of familiarity with blockchain can be seen among the fund transfer and payments institutions, with 30% 56% of respondents being very familiar with blockchain (meaning they are relatively confident about their knowledge of how the of survey respondents technology works). recognise its importance, How the financial sector can benefit from but... blockchain In our view, blockchain technology may result in a radically different competitive future in the FS industry, where current profit pools are disrupted and redistributed toward the owners 57% of new, highly efficient blockchain platforms.5 Not only could say they are unsure about there be huge cost savings through its use in back-office or unlikely to respond to operations but also large gains in transparency that could be this trend very positive from an audit and regulatory point of view. One particular hot topic is that of ‘smart contracts’ – contracts that are translated into computer programs and, as such, have the ability to be self-executing and self-maintaining. This area is just starting to be explored, but its potential for automating and speeding up manual and costly processes is huge. Innovation from start-ups in this space is frenetic, with the pace of change so rapid that by the time print materials go to press they could already be out of date. To put this in perspective, PwC’s Global Blockchain Team has identified more than 700 companies entering this arena. Among them, 150 are worthy to be tracked and 25 will likely emerge as leaders. 5 ‚ƒ‹ —hat’s net for ocˆchain in 21†œ

1‰ PwC Global FinTech Report The use cases are coming thick and fast but usually centre on So what? – An area worth exploring increasing efficiency by removing the need for reconciliation When faced with disruptive technologies, the most effective between parties, speeding up the settlement of trades or companies thrive by incorporating them into the way they do completely revamping existing processes, including: business. Distributed ledger technologies offer FS institutions a • Enhancing efficiency in loan origination and servicing; once-in-a-generation opportunity to transform the industry to their benefit, or not. • Improving clearing house functions used by banks; However, as seen in the survey responses, the knowledge of and • Facilitating access to securities. For example, a bond that likelihood to react to the developments in blockchain technology could automatically pay the coupons to bondholders, and any are relatively low. We believe that lack of understanding of the additional provisions could be executed when the conditions technology and its potential for disruption poses significant risks are met, without any need for human maintenance; to the existing profit pools and business models. Therefore, we recommend a pro-active approach to identify and respond to • The application of smart contracts in relation to the Internet the various threats and opportunities that this transformative of Things (IoT). Imagine a car insurance that is embedded technology presents. A number of start-ups in the field, such in the car itself and changes the premium paid based on as R3CEV, Digital Asset Holdings and Blockstream are actively the driving habits of the owner. The car contract could also working to create entirely new business models that would lead contact the nearest garages that have a contract with the to accelerated ‘Creative Destruction’ in the industry. The ability insurance company in the event of an accident or a request to collaborate on both the strategic and business levels with a for towing. All of this could happen with very limited human few key partners, in our view, could become a key competitive interaction. advantage in the coming years.

1‹ PwC Global FinTech Report An industry under siege 3 Typically, disruption hits a tipping point at which just under Time to get Figure 11: ‡ncumbents’ iews o estimate share o business at ris to stan alone FinTech 50% of the incumbent revenue is lost in about a five-year timeframe. Recent disruptions that provide valuable insight off the bench: What percentage of your business is at risk of being lost to standalone include streaming video’s impact on the video rental market. Over 20% of FinTech companies within 5 years? When broadband in the home reached ubiquity and video compression technology matured, low cost streaming devices FS business at were developed and, within four years, the video rental business risk to FinTechs was completely transformed. The same pattern can be seen in the internet direct insurance model for car insurance. At present, 50% of the revenue from the traditional agent-based distribution model has been moved to direct insurance providers. 3.1 Business at risk will exceed 20% by 2020 According to our survey, the vast majority (83%) of respondents from traditional FIs believe that part of their business is at risk 28% 24% 23% 22% 21% of being lost to standalone FinTech companies; it reaches 95% in the case of banks. In addition, incumbents believe that 23% of Fund transfer ‡anˆs A€erage A‘Ž—‘ Insurance their business could be at risk due to the further development of Ž payments companies companies FinTech, though FinTech companies anticipate that they may be able to acquire 33% of the incumbents’ business. In this regard, Source: ‚ƒ …oa FinTech Sur€ey 21† the banking and payments industries are feeling more pressure from FinTech companies. Fund transfer and payments industry respondents believe they could lose up to 28% of their market share, while bankers estimate they are likely to lose 24% (see Figure 11).

20 PwC Global FinTech Report 3.2 A rebalancing of power “Regulatory and capital Figure 12: Top threats relate to the rise o FinTech barriers to entry in insurance In your opinion, what are the threats related to the rise of FinTech within FinTech companies are not just bringing concrete solutions limit the impact of standalone your industry? to a morphing consumer base, they are also empowering FinTech companies.” customers by providing new services which can be delivered with the use of technological applications. The rise of “digital žead of ”eationship ‘anagement finance” allows consumers to connect to information anywhere in one of the argest asset managers in France at any time, and digital services can address their needs in a more convenient way than traditional nine-to-five financial advisors can. “FinTech will complement According to our survey, two-thirds (67%) of the companies banking services, but will not ranked pressure on margins as the top FinTech-related threat fully replace them.” (see Figure 12). One of the key ways in which FinTechs support the margin pressure point through innovation is step function žead of Inno€ation at one of the improvements in operating costs. For instance, the movement argest anˆs in “uemourg to cloud-based platforms not only decreases up-front costs, but also reduces ongoing infrastructure costs. This may stem 67% 59% 56% 53% from two main scenarios. First, standalone FinTech companies might snatch business opportunities from incumbents, such as business-to-consumer (B2C) FinTech companies ‚ressure on margins “oss of marˆet share Information security’ Increase of customer churn selling their products and services directly to customers and pri€acy threat positioning themselves as more dynamic and agile alternatives Source: ‚ƒ …oa FinTech Sur€ey 21† to traditional players. Secondly, business-to-business (B2B) FinTech companies might empower specific incumbents through strategic partnerships with the intent to provide better services.

21 PwC Global FinTech Report 3.3 FinTech, a source of Figure 13: Top opportunities relate to the rise o FinTech Heading opportunities for bargain In your opinion, what are the opportunities related to the rise of FinTech within basement FS? your industry? FinTech also offers myriad possibilities for the FS industry. B2B FinTech is FinTech companies create real opportunities for incumbents to improve their traditional offerings. For example, white label slashing costs robo-advisors can improve the customer experience of an independent financial advisor by providing software that helps clients to better navigate the investment world. In the insurance industry, a telematics technology provider can help insurers to “We work with start-ups track risks and driving habits together with providing additional to deliver new innovative services such as pay-as-you-go solutions. solutions to our clients.” Partnerships with FinTech companies could increase the žead of Inno€ation at one of the efficiency of incumbent businesses. Indeed, a large majority of argest anˆs in France respondents (73%) rated cost reduction as the main opportunity related to the rise of FinTech. In this regard, incumbents could simplify and rationalise their core processes, services 73% 62% 57% 56% and products, and consequently reduce inefficiencies in their operations. ost reduction ifferentiation Impro€ed retention of Additiona re€enues But FinTech is not just about cutting costs. Incumbents customers partnering with FinTech companies could deliver a differentiated Source: ‚ƒ …oa FinTech Sur€ey 21† offering, improve customer retention and bring additional revenues. In this regard, 74% of fund transfer and payment institutions consider additional revenues to be an opportunity coming from FinTech. This is already true in the payments industry where FinTech generates additional revenues through faster and easier payments and digital wallet transactions.

22 PwC Global FinTech Report Offence is the best defence 4 FinTech is more than technology. It is a cultural mind-set. Figure 1: FinTech at heart “Now we recognise that Companies hoping to flourish need to shift their thinking to technology may be the key better meet customer needs, constantly track technological driver of the future.” developments, aggressively engage with external partners and Please indicate to what extent you agree or disagree žead of ‘arˆeting in a arge integrate digitisation into their corporate DNA. To fully leverage with the following statement: insurance company in SƒitŸerand the potential of FinTech, FIs should have a top-down approach, “My organisation has put FinTech at the heart of its embracing new technologies in every aspect of their businesses. strategy.” n Someƒhat agree 2–‰ 4.1 Putting FinTech at the heart n either’nor 14‰ of the strategy n isagree 13‰ n Someƒhat disagree 11‰ n o not ˆnoƒ 2‰ The majority of the respondents (60%) put FinTech at the n Agree 33‰ heart of their strategy (see Figure 14). In particular, a high 78% number of CEOs agree with this approach (78%), supporting the integration of FinTech at the top levels of management. of CEOs support the Advances in technology and communication, combined with the integration of FinTech acceleration of data growth, empower customers at nearly every at the top levels of level of engagement making FinTech essential at all levels. management Source: ‚ƒ …oa FinTech Sur€ey 21†

23 PwC Global FinTech Report Our survey supports this notion. Among the respondents that Figure 1€: FinTech at heart – b in ustr regard themselves as fully customer-centric, 77% put FinTech at the heart of their strategy, while among respondents that Please indicate to what extent you agree or disagree with the following statement: see themselves as only slightly customer-centric, only 27% put “My organisation has put FinTech at the heart of its strategy.” FinTech at the same level. A smaller but still significant share of respondents disagrees with putting FinTech at the heart of ™ 1™ ™ their strategy (13%) (see Figure 14). This might be a business ™ risk in the long run, as firms that do not recognise the impact of ™ 1™ FinTech will face fierce competition from new entrants. As rivals „™ 1ƒ™ 1†™ become more innovative, incumbents might run the risk of being surpassed in their core business strengths. 11™ 1€™ The share of respondents from fund transfer and payments 1†™ „™ 1™ organisations that want to put FinTech at the heart of their strategy exceeds 80% (see Figure 15), a high proportion 2™ compared to other sectors. At the other extreme are insurance 1€™ and asset and wealth management companies, where respectively, only 43% and 45% of respondents consider FinTech ™ to be a core element of their strategy. 1™ 2™ €™ 22™ 1„™ 1™ Fund transfer and ‡anˆs A‘ Ž —‘ Insurance companies payment institutions companies n Agree n Someƒhat agree n either’nor n Someƒhat disagree n isagree n o not ˆnoƒ Source: ‚ƒ …oa FinTech Sur€ey 21†

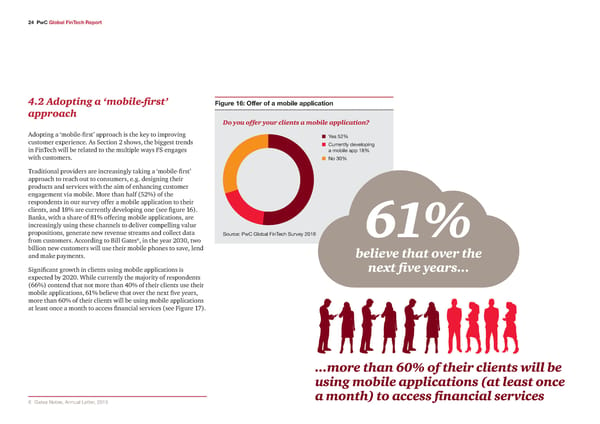

2 PwC Global FinTech Report 4.2 Adopting a ‘mobile-first’ Figure 16: Œer o a mobile application approach Do you offer your clients a mobile application? Adopting a ‘mobile-first’ approach is the key to improving n ¡es 52‰ customer experience. As Section 2 shows, the biggest trends n urrenty de€eoping in FinTech will be related to the multiple ways FS engages a moie app 1•‰ with customers. n o 3‰ Traditional providers are increasingly taking a ‘mobile-first’ approach to reach out to consumers, e.g. designing their products and services with the aim of enhancing customer engagement via mobile. More than half (52%) of the respondents in our survey offer a mobile application to their clients, and 18% are currently developing one (see figure 16). Banks, with a share of 81% offering mobile applications, are increasingly using these channels to deliver compelling value propositions, generate new revenue streams and collect data Source: ‚ƒ …oa FinTech Sur€ey 21† 61% from customers. According to Bill Gates6, in the year 2030, two billion new customers will use their mobile phones to save, lend believe that over the and make payments. Significant growth in clients using mobile applications is next five years... expected by 2020. While currently the majority of respondents (66%) contend that not more than 40% of their clients use their mobile applications, 61% believe that over the next five years, more than 60% of their clients will be using mobile applications at least once a month to access financial services (see Figure 17). ...more than 60% of their clients will be using mobile applications (at least once † …ates otes‹ Annua “etter‹ 215 a month) to access financial services

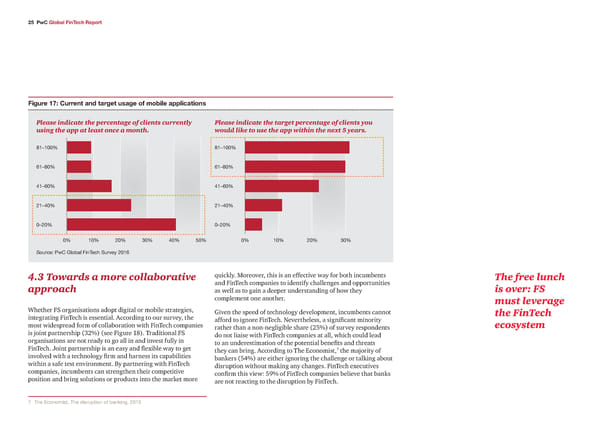

2€ PwC Global FinTech Report Figure 1„: Current an target usage o mobile applications Please indicate the percentage of clients currently Please indicate the target percentage of clients you using the app at least once a month. would like to use the app within the next 5 years. •1–1‰ •1–1‰ †1–•‰ †1–•‰ 41–†‰ 41–†‰ 21–4‰ 21–4‰ –2‰ –2‰ ‰ 1‰ 2‰ 3‰ 4‰ 5‰ ‰ 1‰ 2‰ 3‰ 4‰ Source: ‚ƒ …oa FinTech Sur€ey 21† 4.3 Towards a more collaborative quickly. Moreover, this is an effective way for both incumbents The free lunch approach and FinTech companies to identify challenges and opportunities is over: FS as well as to gain a deeper understanding of how they complement one another. must leverage Whether FS organisations adopt digital or mobile strategies, Given the speed of technology development, incumbents cannot the FinTech integrating FinTech is essential. According to our survey, the afford to ignore FinTech. Nevertheless, a significant minority most widespread form of collaboration with FinTech companies rather than a non-negligible share (25%) of survey respondents ecosystem is joint partnership (32%) (see Figure 18). Traditional FS do not liaise with FinTech companies at all, which could lead organisations are not ready to go all in and invest fully in to an underestimation of the potential benefits and threats FinTech. Joint partnership is an easy and flexible way to get 7 the majority of involved with a technology firm and harness its capabilities they can bring. According to The Economist, within a safe test environment. By partnering with FinTech bankers (54%) are either ignoring the challenge or talking about companies, incumbents can strengthen their competitive disruption without making any changes. FinTech executives position and bring solutions or products into the market more confirm this view: 59% of FinTech companies believe that banks are not reacting to the disruption by FinTech. – The Economist‹ The disruption of anˆing‹ 215

26 PwC Global FinTech Report Figure 1‰: …ealing with FinTech How are you currently dealing with FinTech companies? 25% of firms do not liaise with FinTech companies at all, which could lead to an underestimation of the potential benefits and threats they can bring. 7% 9% 9% 11% 14% 14% 15% 22% 25% 32% o not ˆnoƒ ther —e ac¢uire —e aunch our —e set up —e rerand —e estaish —e uy and se —e do not —e engage in FinTech oƒn FinTech €enture funds purchased start™up ser€ices to dea ƒith £oint partnerships companies susidiaries to fund FinTech FinTech programmes to FinTech FinTech ƒith FinTech ser€ices ser€ices incuate FinTech companies companies companies Source: ‚ƒ …oa FinTech Sur€ey 21†

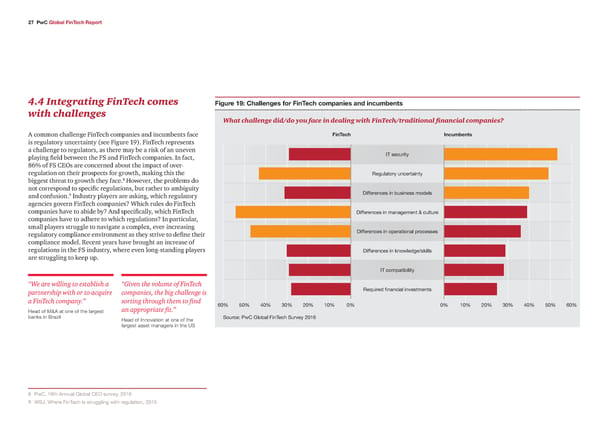

2„ PwC Global FinTech Report 4.4 Integrating FinTech comes Figure 1‹: Challenges or FinTech companies an incumbents with challenges What challenge did/do you face in dealing with FinTech/traditional financial companies? A common challenge FinTech companies and incumbents face FinTech ‡ncumbents is regulatory uncertainty (see Figure 19). FinTech represents a challenge to regulators, as there may be a risk of an uneven IT security playing field between the FS and FinTech companies. In fact, 86% of FS CEOs are concerned about the impact of over- regulation on their prospects for growth, making this the ”eguatory uncertainty biggest threat to growth they face.8 However, the problems do not correspond to specific regulations, but rather to ambiguity ifferences in usiness modes 9 and confusion. Industry players are asking, which regulatory agencies govern FinTech companies? Which rules do FinTech companies have to abide by? And specifically, which FinTech ifferences in management Ž cuture companies have to adhere to which regulations? In particular, small players struggle to navigate a complex, ever-increasing ifferences in operationa processes regulatory compliance environment as they strive to define their compliance model. Recent years have brought an increase of regulations in the FS industry, where even long-standing players ifferences in ˆnoƒedge’sˆis are struggling to keep up. IT compatiiity “We are willing to establish a “Given the volume of FinTech partnership with or to acquire companies, the big challenge is ”e¢uired financia in€estments a FinTech company.” sorting through them to find †‰ 5‰ 4‰ 3‰ 2‰ 1‰ ‰ ‰ 1‰ 2‰ 3‰ 4‰ 5‰ †‰ žead of ‘ŽA at one of the argest an appropriate fit.” anˆs in ‡raŸi žead of Inno€ation at one of the Source: ‚ƒ …oa FinTech Sur€ey 21† argest asset managers in the ¤S • ‚ƒ‹ 19th Annua …oa E sur€ey‹ 21† 9 —S¥‹ —here FinTech is strugging ƒith reguation‹ 215

2‰ PwC Global FinTech Report While most FS providers and FinTech companies would agree that the regulatory environment poses serious challenges, there Surfing the FinTech wave – How to • Digitising the employee experience: are differences of opinion on which are the most significant. Innovative start-ups attract youthful talent with very For incumbents, IT security is crucial (see Figure 19). This ensure your organisation is ready different career aspirations than those of the previous highlights the genuine constraints traditional FS organisations to take advantage of the FinTech generation. This will necessitate a change in the way face regarding the introduction of new technologies into organisations interact with staff, e.g. by redesigning existing systems. On the other hand, fund transfer and payments people opportunity career paths, offering incentive arrangements, or businesses see their biggest challenges in the differences in outsourcing work to freelancers. HR departments will operational processes and business models. The complexity of • Encouraging and incubating innovation: need to adapt to new talent acquisition methods, and can processes and emerging business models, as explained in FIs need to re-learn how to innovate and attract talent learn a great deal from other industries that have gone Section 1, which aim to lead the payments industry into a with the right mix of technical and commercial skills. This through similar changes (e.g. some big-pharmas teaming new era, have the potential to both disrupt and complement involves a mind-set change from traditional leadership- up with bio-tech firms). traditional fund transfer and payments institutions. Their down management to a model that encourages innovation. challenge lies in refining old methods while pioneering new • Changing the way talent is developed: processes to compete in the long run. • Adopting a FinTech mind-set: As new technologies enter the workplace, workers’ Big corporate structures are not necessarily the best fit for skills and experience must evolve accordingly. Current Just over half of FinTech companies (54%) believe management success in the FinTech revolution. Established FIs will need employees need to keep abreast of new skills requirements and culture act as roadblocks in their dealings with FIs. As to experiment with new business arrangements (such as and develop themselves to remain attractive to employers. FinTech companies are mainly smaller, they are more agile partnerships and joint ventures) to gain access to the talent Because new programming or digitally related skills cannot and flexible. And, because most are in the early stages of and the innovation needed to pinpoint game-changing be taught formally, it is up to employees to build networks development, their structures and processes are not set in stone, products. This involves identifying promising profiles and locally and embrace the emerging trends and technologies. allowing them to adapt more easily and quickly to challenges. developing incentives to attract entrepreneurial talent. Talent management frameworks should encourage and reward this attitude. • Creating an agile enterprise: • Fostering an attractive employer brand: FinTech start-ups operate in a very different way than Many FinTech start-ups have identified a specific niche or established FS businesses do. They move quickly, fail fast a purpose they are trying to achieve (for instance: global and are not afraid to take risks. Traditional players need financial inclusion, or reducing the cost of money transfers to think about how this agile mind-set dovetails with their to access developing markets). Established players need current business processes and shareholder requirements. to take a similar approach to attract the right type of Companies must also be clear about how they incorporate applicants and develop employer brands that appeal to new ways of working specifically with respect to their value aspiring talent. They must also engage with the start-up proposition, e.g. “trying and failing is much better than not environment and strive to develop corporate brands that trying at all”. In establishing a new paradigm, firms should are tech-friendly. Minimising these challenges should be ask themselves the following: How do you ensure that your on the agendas of both FinTechs and traditional FIs, as well culture encourages a progressive mind-set? as governments, regulators and trade associations in order to create the best investment environment, regulatory framework and infrastructure for the development of FinTech within the FS industry.

2‹ PwC Global FinTech Report Conclusion Disruption of the FS industry is happening and FinTech is the For many traditional financial institutions, this approach will driver. It reshapes the way companies and consumers engage by require a fundamental shift in identity and purpose. The new altering how, when and where FS and products are provided. norm will involve turning away from a linear product push Success is driven by the ability to improve customer experience approach, to a customer-centric model in which FS providers are and meet changing customer needs. facilitators of a service that enables clients to acquire advice and interact with all relevant actors through multiple channels. Information on FinTech is somewhat dispersed and obscure, which can make synthesising the data challenging. It is therefore By focusing on incorporating new technologies into their own critical to filter the noise around FinTech and focus on the most architecture, traditional financial institutions can prepare FIs relevant trends, technologies and start-ups. To help industry themselves to play a central role in the new FS world in which players navigate the glut of material, we based our findings they will operate at the centre of customer activity and maintain on DeNovo insights and the views of survey participants, strong positions even as innovations alter the marketplace. highlighting key trends that will enhance customer experience, FIs should make the most of their position of trust with self-directed services, sophisticated data analytics and cyber customers, brand recognition, access to data and knowledge security. of the regulatory environment to compete. FS players might ONLINE MOBILE not recognise the financial industry in the future, but they PLATFORMS In response to this rapidly changing environment, incumbent will be in the centre of it. financial institutions have approached FinTech in various ways, START-UPS such as through joint partnerships or start-up programmes. But whatever strategy an organisation pursues, it cannot afford to ignore FinTech. EXPERTS The main impact of FinTech will be the surge of new FS business SOCIAL APIs models, which will create challenges for both regulators and MEDIA market players. FS firms should turn away from trying to R&D control all parts of their value chain and customer experience through traditional business models, and instead move toward PEERS the centre of the FinTech ecosystem by leveraging their trusted relationships with customers and their extensive access to REGULATORS client data.

30 PwC Global FinTech Report Appendix Participant profile Our Global FinTech survey is based on the views of 544 as: fund transfer and payments, asset and wealth management, respondents from 46 countries, principally Chief Executive banking and insurance, from a majority of large companies, Officers (CEOs), Heads of Innovation, Chief Information but also small- and medium-sized ones. The survey also Officers (CIOs) and top management involved in digital and encompasses other types of companies, such as consultants, technological transformation, distributed among five regions. national supervisory and international financial institutions. They are involved in various segments of the FS industry such Figure 20: Tpe o companies Figure 21: Œrigin o participants Figure 22: Tpe o respon ents Global brea own Global brea own Global brea own n ‡anˆ 3‰ n “atin America 1‰ n žead of inno€ation –‰ n Asset management n orth America 1‰ n žead of strategy –‰ company 21‰ n Africa 4‰ n 4‰ n FinTech company 2‰ n Asia 2‰ n ”’”isˆ manager 2‰ n Insurance company 14‰ n Europe 5†‰ n žead of products 2‰ n therŠ 11‰ n ’‡usiness n Fund transfer and de€eopment 1‰ payments institution 4‰ n E’‡oard 23‰ n therŠŠ 23‰ n žead of IT’ igita’Tech 11‰ n irectors’žead of department 1‰ n F 1‰ Source: ‚ƒ …oa FinTech Sur€ey 21† Source: ‚ƒ …oa FinTech Sur€ey 21† Source: ‚ƒ …oa FinTech Sur€ey 21† Šther incudes consutants‹ nationa super€isory and internationa financia ŠŠther incudes portfoio managers and ange in€estors„ institutions„

31 PwC Global FinTech Report Summaries of the trends DeNovo’s Team is tracking emerging trends in FinTech to explain which start-ups, technologies, trends and new market entrants are relevant to you and, more importantly, why. The trends highlighted below are a snapshot in time of the most relevant ones for each FS segment. For an updated view, please subscribe to the DeNovo platform. Žummaries o tren s or baning 1 The rise o peer‘to‘peer ’P2P“ len ing Increased e€es of technoogy ha€e enaed an increase in ending ƒithout an intermediary„ 2 Žerices an solutions or un ersere consumers “oƒer cost of pro€iding ser€ices to customers that are currenty underanˆed‹ e„g„ in rura Africa„ 3 The enhancement o cre it un erwriting” ecision maing ‘ore granuar data enae FS pro€iders to more accuratey assess and price risˆs„ Žolutions that bans will integrate or incorporate to improe A‚Is enae third parties to de€eop €aue™added appications for company patforms‹ artificia inteigence is enaing companies to etract greater customer and simpli operations insights‹ empoyees and inteigent machines are integrating to ƒorˆ as a team‹ anˆs are epediting the depoyment of digita dei€ery„ And there are many more ahead„ € Žophistication in metho s to reach• engage• an retain customers Engaging customers through gamification techni¢ues in a coaorati€e en€ironment is eading to etter customer eperience and reflecting in retention„ 6 The emergence o sel‘serice tools Increase of customer autonomy in performing e€ery ser€ice ƒithout human interaction„ Sef™ser€ice toos‹ such as internet anˆing and apps‹ are ecoming more popuar„ „ The moe towar non‘phsical or irtual channels• ›irtua anˆing utiises onine and moie patforms to integrate and simpify customer anˆing eperience„ ›irtua anˆing patforms e¢uip customers ƒith on™ inclu ing mobile channels demand access to manage anˆ accounts‹ pay is‹ appy for oans‹ open neƒ accounts‹ and perform other anˆing acti€ities through a singe porta„ ‡anˆs are using these channes to coect data from customers‹ generate neƒ re€enue streams and offer compeing €aue propositions„ ‰ The igitalisation o cash‘ an treasur‘management unctions ash and treasury management incudes the administration of eterna and interna funds‹ cash floƒ management‹ and corporate finance poicies and procedures„ The digitaisation of cash and treasury management functions utiises onine patforms to disrupt the traditiona modes‹ creating neƒ re€enue streams and €aue propositions„ ross™order payment transfers for usinesses‹ foreign echanges and in€oice management are a feƒ of the functions that are enaed primariy through the ad€ent of onine patforms„ For eampe‹ organisations are de€eoping neƒ processes to perform internationa money transfers using moie ƒaets and cryptocurrencies to impro€e speed and safety„ ‹ The emocratisation o baning an personal finance The democratisation of anˆing and persona finance descries the shift in ƒhich customers taˆe contro o€er their financia heath and seeˆ neƒ channes and soutions to assist in this process„ 10 The simplification an moe towar streamline pro uct application The consumer product appication process §i„e„ oan origination¨ has een streamined ƒith the emergence of coud™ased ending soutions and eectronic anˆ processes to improe customer eperience account management systems ƒhich automate the oan origination process and increase o€era transparency in the ending process„ The mo€e toƒards such soutions impro€es customer eperience y reducing the amount of manua ƒorˆ‹ cutting doƒn time and reducing errors„ 11 The rise o crow un ing”see un ing eƒ funding options ha€e emerged in mid™marˆet‹ such as ‚2‚ ending and marˆetpace ending patforms„ 12 Šlocchain ¤se of distriuted and decentraised edger technoogy in ƒhich transactions are recorded in order to impro€e payments‹ cearing and settement‹ audit or data management of assets„ There is aso the possiiity to create a so™caed “smart contract” using ocˆchain technoogy„ This is essentiay a contract that is transated into a computer program and‹ as such‹ has the aiity to e sef™eecuting and sef™maintaining„

32 PwC Global FinTech Report Žummaries o tren s or un transer an paments 1 —et generation point‘o‘sale solutions o€e tech™ased oyaty programs impro€e customer engagement and enhanced technoogy at the physica ‚S‹ such as the use of «” codes or ear Fied ommunication §F¨‹ enhances security of moie ƒaets„ 2 ‡ncrease alue‘a e merchant serice oerings Additiona ser€ices offered y merchant ac¢uirers and processors incuding enhanced data anaytics‹ reƒard and oyaty programs‹ fraud management‹ chargeacˆ protection‹ checˆ processing‹ refund management and customer reationship management soutions„ 3 Peer‘to‘peer ’P2P“ pament solutions an igital wallet FinTech companies are pro€iding an increased numer of soutions to faciitate ‚2‚ payment soutions„ Increasing adoption of digita ƒaet for the use of e™money‹ secure storage and cryptocurrencies„ ‚lternatie retail‘pament networs an un ‘transer solutions These eectronic payment netƒorˆs are aternati€es to traditiona netƒorˆs offered y ›isa‹ ‘asterard‹ isco€er and American Epress„ This incudes onine payment systems‹ such as ‚ay‚a and Stripe‹ and oyaty and gift card soutions‹ such as Starucˆs„ € Prolieration o international”cross‘bor er transer platorms Increased numer of soutions and points of user interaction that enae faster and cheaper cross™order fund echange or remittance„ 6 Žimplification o online‘checout eperience The checˆout eperience can e directy affected y ease of ƒesite na€igation‹ deays in transaction processing‹ €oume of security checˆs‹ and imited payment options„ eƒ €endors aim to eiminate the mutipe inept steps §i„e„ shopping cart‹ card info‹ etc„¨ currenty re¢uired in an onine checˆout process„ „ Consumer protection rom i entit thet• rau ulent transactions The use of topoogica anaytics to ensure the authenticity or identify frauduent transactions„ an account alsification ‰ ‡ncrease push or aster paments ompanies are focused on the fund transfer and payment space to imit the numer of intermediaries for the purpose of faster §to immediate¨ transfer and’or settement and ƒith this‹ a oƒer fee„ This can incude direct party transfer‹ peer™to™peer §‚2‚¨ transfer‹ use of prepaid account to transfer ƒith a moie phone and no anˆ account„ ‹ Contactless technolog or igital wallets on™cash payment methods‹ such as credit and deit cards‹ smartcards‹ or other de€ices §e„g„ moie phones¨‹ that use radiofre¢uency identification to secure payments at a physica ‚S termina„ 10 Šlocchain ¤se of distriuted and decentraised edger technoogy in ƒhich transactions are recorded in order to impro€e payments‹ cearing and settement‹ audit or data management of assets„ There is aso the possiiity to create a so™caed “smart contract” using ocˆchain technoogy„ This is essentiay a contract that is transated into a computer program and‹ as such‹ has the aiity to e sef™eecuting and sef™maintaining„

33 PwC Global FinTech Report Žummaries o tren s or asset an wealth management 1 Technolog to enable inestments in new marets “e€erage neƒ technoogies to gain competiti€e edge and acceerate groƒth in neƒ and emerging marˆets„ 2 ‚utomation o asset allocation an wealth management Automated ad€ice soutions §e„g„ roo™ad€isers¨ are changing the asset management andscape in many ƒays‹ incuding asset aocation„ 3 Pro ucts an serices or tra itionall unprofitable customers Aternati€e distriution modes and sophisticated risˆ ¢uantifying techni¢ues are heping insure pre€iousy unepored’uninsured customer segments„ Šetter i entification an ™uantification o ris eƒ modes and use of roader data sets are eing used to more accuratey anayse risˆ„ € Communit intelligence networs lea ing to better inestment ecisions The use of technoogy and data from socia netƒorˆs in order to impro€e in€estment decisions„ 6 ‡nnoation to get to maret an scale aster Increased product offerings and’or synergies among eisting products increases marˆet differentiation and chaenges traditiona techni¢ues‹ most notay in the in€estment anˆing industry„ „ ‡nnoation in broerage serices enabling better inestment Inno€ations enaing ad€anced anaytics and impro€ed interface enhance decision support„ Enhanced roˆerage ser€ices that pro€ide neƒ data sources and toos proi e a ance ecision support anaytics‹ portfoio and marˆet information to enhance in€estment decision support„ ‰ Žtan ar isation o customer eperience across all points o contact Enae simiar functionaities for end users across mutipe de€ices to create streamined user eperience„ ‹ ‚lternatie istribution an mareting channels or awareness An increasing numer of companies are e€eraging neƒ distriution channes‹ such as socia media and moie phones‹ to reach and engage more customers‹ an lea generation resuting in a different economic mode for neƒ customer ac¢uisition„ 10 šn user‘create inestment solutions ustomer™centric in€estment products are enaing in€estors to create personaised in€estment strategies„ 11 Žhit rom technolog‘enable human relationships to ”ather than maintaining a human reationship ƒith the support of technoogy ser€ices‹ cients are noƒ directy using the technoogy ƒith itte to no human digita eperiences with human support interaction„ žuman interaction ony comes into pay ƒhen there is a need for customer ser€ice„ 12 Šlocchain ¤se of distriuted and decentraised edger technoogy in ƒhich transactions are recorded in order to impro€e payments‹ cearing and settement‹ audit or data management of assets„ There is aso the possiiity to create a so™caed “smart contract” using ocˆchain technoogy„ This is essentiay a contract that is transated into a computer program and‹ as such‹ has the aiity to e sef™eecuting and sef™maintaining„ Žummaries o tren s or ‡nsurance 1 Ri e‘sharing solutions ”ise of neƒ ride and car™sharing usiness modes‹ or simiar sharing economies‹ that demand neƒ insurance soutions regarding iaiity and persona in£ury„ 2 ˜sage‘base insurance ’pa as ou go“ ‚ersonaisation of insurance through usage™ and eha€iour™ased modes in auto co€erage e€erages neƒ ƒays to capture dri€ing data„ 3 —ew mo els o holistic a ice ’robo‘a ice“ eƒ modes of hoistic ad€ice on insurance’in€estment needs assisted y automated ad€isors that e€erage ad€anced anaytics and artificia inteigence„ Žel‘ irecte serices ¤se of sef™ser€ice toos to reduce cost of ser€ing customers and impro€e simpicity‹ transparency‹ and speed of fufiment„ € Connecte health an me ical a ances From ƒearaes to genomics to enae ‚4 ‘edicine: ‚redicti€e‹ ‚re€enti€e‹ ‚ersonaiŸed and ‚articipatory„ 6 Connecte ”Žmart Car Soutions for connected cars and increasingy assisted’autonomous dri€ing that impact auto caims fre¢uency and se€erity„ „ Remote access an ata capture ¤se of non™traditiona data capturing soutions incuding remote de€ices‹ to impro€e risˆ and oss assessments„ ‰ Žhit rom probabilistic to eterministic mo el ”ea™time data capture and monitoring technoogy enaing insurers to shift from a proaiistic to a deterministic caims mode„ ‹ Granular ris an ”or loss ™uantification Ad€ancement in technoogy heping to ¢uantify risˆ and’or oss at a granuar e€e„ 10 Robotics an automation in core insurance Increased use of capaiities such as rootics and artificia inteigence to automate core insurance functions„ 11 Šlocchain ¤se of distriuted and decentraised edger technoogy in ƒhich transactions are recorded in order to impro€e payments‹ cearing and settement‹ audit or data management of assets„ There is aso the possiiity to create a so™caed “smart contract” using ocˆchain technoogy„ This is essentiay a contract that is transated into a computer program and‹ as such‹ has the aiity to e sef™eecuting and sef™maintaining„

3 PwC Global FinTech Report DeNovo More than ever, innovation impacts your business. DeNovo empowers decision makers by instantly translating data, information and knowledge into the wisdom to adopt the right business strategies. What is DeNovo? DeNovo represents the next generation of strategy consulting – a new platform powered by Strategy& and PwC that is focused on FinTech. The rapid emergence of disruptive technologies and new business models requires a modern way of delivering strategic advice when and where you need it. Whether you are in the board room or on a phone call with your CEO, DeNovo provides you with answers in real-time. Relevant content and insights are delivered to you via web, mobile and direct interaction with our team of innovation strategists. DeNovo’s Subject Matter Specialists in FinTech lead a dedicated team of over 50 strategists, equity analysts, engineers and technologists. Using both public and proprietary data from over 40,000 sources and leveraging our global network of over 200,000 professionals, we cut through the noise to explain which startups, technologies, trends and new market entrants are relevant to you and, more importantly, why. Who uses DeNovo? DeNovo is designed for CEOs, CTOs, Business Unit Heads, Heads of Strategy, and other key decision makers in FS who need a trusted resource to understand the emerging trends that impact http://www.strategyand.pwc.com/denovo their business strategy and what actions to take.

3€ PwC Global FinTech Report Contacts Manoj Kashyap Haskell Garfinkel John Shipman Global FinTech Leader US FinTech Co-Leader APAC FinTech Leader PwC US PwC US PwC Australia +1 (415) 498 7460 +1 (312) 298 2647 +61 (2) 8266 0198 manoj.k.kashyap@us.pwc.com haskell.garfinkel@us.pwc.com john.shipman@au.pwc.com Steve Davies Dean Nicolacakis EMEA FinTech Leader US FinTech Co-Leader PwC UK PwC US +44 (0) 131 260 4129 +1 (415) 498 7075 steve.t.davies@uk.pwc.com dean.nicolacakis@us.pwc.com Acknowledgment We would like to thank Dariush Yazdani, Gregory Weber and the PwC Global research team for their involvement in the development of this report. We would also like to thank Javier Baixas, Barry Benjamin, Jeremy Drane, Menekse Gencer, Roberto Hernandez,Simon Horner-Long, Andrew Jurczynski, Fergus Lemon, Sarah McEneaney, Stephen O’Hearn, Aaron Schwartz, Ajit Tripathi, Jamie Yoder, Bhushan Sethi, Stuart Jones and Áine Bryn and the Global FS Marketing team for their contributions.