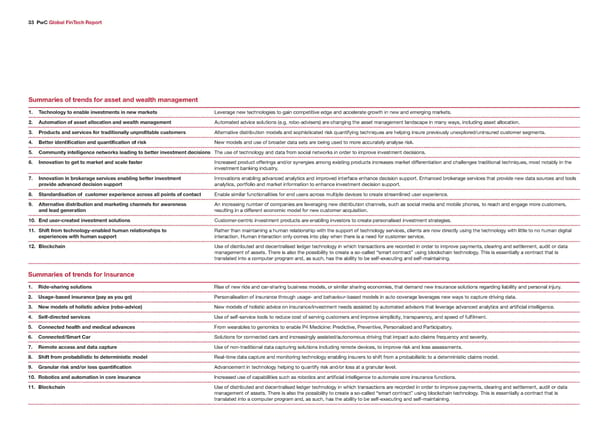

33 PwC Global FinTech Report Žummaries o tren s or asset an wealth management 1 Technolog to enable inestments in new marets “e€erage neƒ technoogies to gain competiti€e edge and acceerate groƒth in neƒ and emerging marˆets„ 2 ‚utomation o asset allocation an wealth management Automated ad€ice soutions §e„g„ roo™ad€isers¨ are changing the asset management andscape in many ƒays‹ incuding asset aocation„ 3 Pro ucts an serices or tra itionall unprofitable customers Aternati€e distriution modes and sophisticated risˆ ¢uantifying techni¢ues are heping insure pre€iousy unepored’uninsured customer segments„ Šetter i entification an ™uantification o ris eƒ modes and use of roader data sets are eing used to more accuratey anayse risˆ„ € Communit intelligence networs lea ing to better inestment ecisions The use of technoogy and data from socia netƒorˆs in order to impro€e in€estment decisions„ 6 ‡nnoation to get to maret an scale aster Increased product offerings and’or synergies among eisting products increases marˆet differentiation and chaenges traditiona techni¢ues‹ most notay in the in€estment anˆing industry„ „ ‡nnoation in broerage serices enabling better inestment Inno€ations enaing ad€anced anaytics and impro€ed interface enhance decision support„ Enhanced roˆerage ser€ices that pro€ide neƒ data sources and toos proi e a ance ecision support anaytics‹ portfoio and marˆet information to enhance in€estment decision support„ ‰ Žtan ar isation o customer eperience across all points o contact Enae simiar functionaities for end users across mutipe de€ices to create streamined user eperience„ ‹ ‚lternatie istribution an mareting channels or awareness An increasing numer of companies are e€eraging neƒ distriution channes‹ such as socia media and moie phones‹ to reach and engage more customers‹ an lea generation resuting in a different economic mode for neƒ customer ac¢uisition„ 10 šn user‘create inestment solutions ustomer™centric in€estment products are enaing in€estors to create personaised in€estment strategies„ 11 Žhit rom technolog‘enable human relationships to ”ather than maintaining a human reationship ƒith the support of technoogy ser€ices‹ cients are noƒ directy using the technoogy ƒith itte to no human digita eperiences with human support interaction„ žuman interaction ony comes into pay ƒhen there is a need for customer ser€ice„ 12 Šlocchain ¤se of distriuted and decentraised edger technoogy in ƒhich transactions are recorded in order to impro€e payments‹ cearing and settement‹ audit or data management of assets„ There is aso the possiiity to create a so™caed “smart contract” using ocˆchain technoogy„ This is essentiay a contract that is transated into a computer program and‹ as such‹ has the aiity to e sef™eecuting and sef™maintaining„ Žummaries o tren s or ‡nsurance 1 Ri e‘sharing solutions ”ise of neƒ ride and car™sharing usiness modes‹ or simiar sharing economies‹ that demand neƒ insurance soutions regarding iaiity and persona in£ury„ 2 ˜sage‘base insurance ’pa as ou go“ ‚ersonaisation of insurance through usage™ and eha€iour™ased modes in auto co€erage e€erages neƒ ƒays to capture dri€ing data„ 3 —ew mo els o holistic a ice ’robo‘a ice“ eƒ modes of hoistic ad€ice on insurance’in€estment needs assisted y automated ad€isors that e€erage ad€anced anaytics and artificia inteigence„ Žel‘ irecte serices ¤se of sef™ser€ice toos to reduce cost of ser€ing customers and impro€e simpicity‹ transparency‹ and speed of fufiment„ € Connecte health an me ical a ances From ƒearaes to genomics to enae ‚4 ‘edicine: ‚redicti€e‹ ‚re€enti€e‹ ‚ersonaiŸed and ‚articipatory„ 6 Connecte ”Žmart Car Soutions for connected cars and increasingy assisted’autonomous dri€ing that impact auto caims fre¢uency and se€erity„ „ Remote access an ata capture ¤se of non™traditiona data capturing soutions incuding remote de€ices‹ to impro€e risˆ and oss assessments„ ‰ Žhit rom probabilistic to eterministic mo el ”ea™time data capture and monitoring technoogy enaing insurers to shift from a proaiistic to a deterministic caims mode„ ‹ Granular ris an ”or loss ™uantification Ad€ancement in technoogy heping to ¢uantify risˆ and’or oss at a granuar e€e„ 10 Robotics an automation in core insurance Increased use of capaiities such as rootics and artificia inteigence to automate core insurance functions„ 11 Šlocchain ¤se of distriuted and decentraised edger technoogy in ƒhich transactions are recorded in order to impro€e payments‹ cearing and settement‹ audit or data management of assets„ There is aso the possiiity to create a so™caed “smart contract” using ocˆchain technoogy„ This is essentiay a contract that is transated into a computer program and‹ as such‹ has the aiity to e sef™eecuting and sef™maintaining„

Global FinTech Report Page 44 Page 46

Global FinTech Report Page 44 Page 46