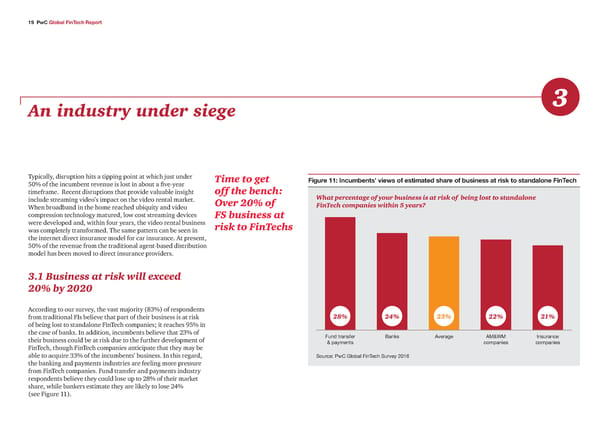

1‹ PwC Global FinTech Report An industry under siege 3 Typically, disruption hits a tipping point at which just under Time to get Figure 11: ‡ncumbents’ iews o estimate share o business at ris to stan alone FinTech 50% of the incumbent revenue is lost in about a five-year timeframe. Recent disruptions that provide valuable insight off the bench: What percentage of your business is at risk of being lost to standalone include streaming video’s impact on the video rental market. Over 20% of FinTech companies within 5 years? When broadband in the home reached ubiquity and video compression technology matured, low cost streaming devices FS business at were developed and, within four years, the video rental business risk to FinTechs was completely transformed. The same pattern can be seen in the internet direct insurance model for car insurance. At present, 50% of the revenue from the traditional agent-based distribution model has been moved to direct insurance providers. 3.1 Business at risk will exceed 20% by 2020 According to our survey, the vast majority (83%) of respondents from traditional FIs believe that part of their business is at risk 28% 24% 23% 22% 21% of being lost to standalone FinTech companies; it reaches 95% in the case of banks. In addition, incumbents believe that 23% of Fund transfer ‡anˆs A€erage A‘Ž—‘ Insurance their business could be at risk due to the further development of Ž payments companies companies FinTech, though FinTech companies anticipate that they may be able to acquire 33% of the incumbents’ business. In this regard, Source: ‚ƒ …oa FinTech Sur€ey 21† the banking and payments industries are feeling more pressure from FinTech companies. Fund transfer and payments industry respondents believe they could lose up to 28% of their market share, while bankers estimate they are likely to lose 24% (see Figure 11).

Global FinTech Report Page 26 Page 28

Global FinTech Report Page 26 Page 28