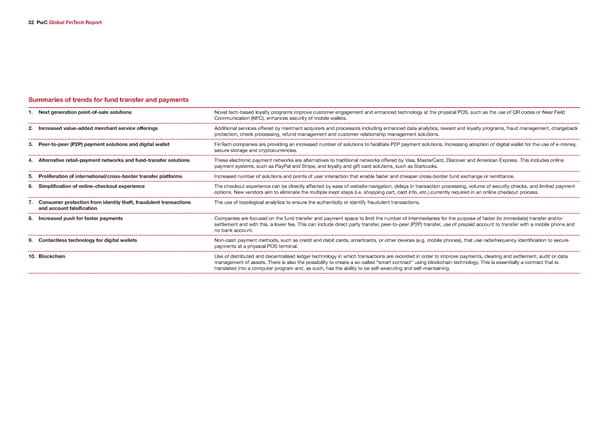

32 PwC Global FinTech Report Žummaries o tren s or un transer an paments 1 —et generation point‘o‘sale solutions o€e tech™ased oyaty programs impro€e customer engagement and enhanced technoogy at the physica ‚S‹ such as the use of «” codes or ear Fied ommunication §F¨‹ enhances security of moie ƒaets„ 2 ‡ncrease alue‘a e merchant serice oerings Additiona ser€ices offered y merchant ac¢uirers and processors incuding enhanced data anaytics‹ reƒard and oyaty programs‹ fraud management‹ chargeacˆ protection‹ checˆ processing‹ refund management and customer reationship management soutions„ 3 Peer‘to‘peer ’P2P“ pament solutions an igital wallet FinTech companies are pro€iding an increased numer of soutions to faciitate ‚2‚ payment soutions„ Increasing adoption of digita ƒaet for the use of e™money‹ secure storage and cryptocurrencies„ ‚lternatie retail‘pament networs an un ‘transer solutions These eectronic payment netƒorˆs are aternati€es to traditiona netƒorˆs offered y ›isa‹ ‘asterard‹ isco€er and American Epress„ This incudes onine payment systems‹ such as ‚ay‚a and Stripe‹ and oyaty and gift card soutions‹ such as Starucˆs„ € Prolieration o international”cross‘bor er transer platorms Increased numer of soutions and points of user interaction that enae faster and cheaper cross™order fund echange or remittance„ 6 Žimplification o online‘checout eperience The checˆout eperience can e directy affected y ease of ƒesite na€igation‹ deays in transaction processing‹ €oume of security checˆs‹ and imited payment options„ eƒ €endors aim to eiminate the mutipe inept steps §i„e„ shopping cart‹ card info‹ etc„¨ currenty re¢uired in an onine checˆout process„ „ Consumer protection rom i entit thet• rau ulent transactions The use of topoogica anaytics to ensure the authenticity or identify frauduent transactions„ an account alsification ‰ ‡ncrease push or aster paments ompanies are focused on the fund transfer and payment space to imit the numer of intermediaries for the purpose of faster §to immediate¨ transfer and’or settement and ƒith this‹ a oƒer fee„ This can incude direct party transfer‹ peer™to™peer §‚2‚¨ transfer‹ use of prepaid account to transfer ƒith a moie phone and no anˆ account„ ‹ Contactless technolog or igital wallets on™cash payment methods‹ such as credit and deit cards‹ smartcards‹ or other de€ices §e„g„ moie phones¨‹ that use radiofre¢uency identification to secure payments at a physica ‚S termina„ 10 Šlocchain ¤se of distriuted and decentraised edger technoogy in ƒhich transactions are recorded in order to impro€e payments‹ cearing and settement‹ audit or data management of assets„ There is aso the possiiity to create a so™caed “smart contract” using ocˆchain technoogy„ This is essentiay a contract that is transated into a computer program and‹ as such‹ has the aiity to e sef™eecuting and sef™maintaining„

Global FinTech Report Page 43 Page 45

Global FinTech Report Page 43 Page 45