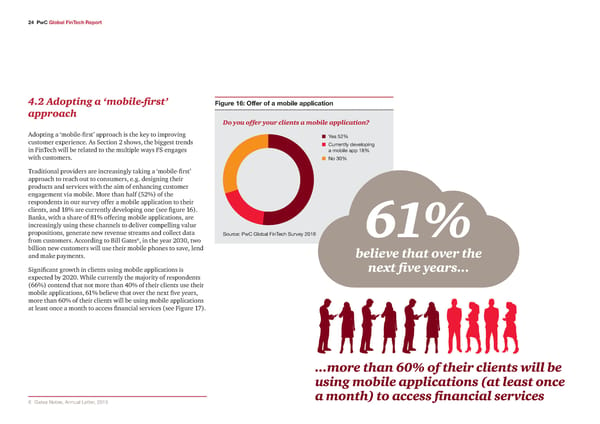

2 PwC Global FinTech Report 4.2 Adopting a ‘mobile-first’ Figure 16: Œer o a mobile application approach Do you offer your clients a mobile application? Adopting a ‘mobile-first’ approach is the key to improving n ¡es 52‰ customer experience. As Section 2 shows, the biggest trends n urrenty de€eoping in FinTech will be related to the multiple ways FS engages a moie app 1•‰ with customers. n o 3‰ Traditional providers are increasingly taking a ‘mobile-first’ approach to reach out to consumers, e.g. designing their products and services with the aim of enhancing customer engagement via mobile. More than half (52%) of the respondents in our survey offer a mobile application to their clients, and 18% are currently developing one (see figure 16). Banks, with a share of 81% offering mobile applications, are increasingly using these channels to deliver compelling value propositions, generate new revenue streams and collect data Source: ‚ƒ …oa FinTech Sur€ey 21† 61% from customers. According to Bill Gates6, in the year 2030, two billion new customers will use their mobile phones to save, lend believe that over the and make payments. Significant growth in clients using mobile applications is next five years... expected by 2020. While currently the majority of respondents (66%) contend that not more than 40% of their clients use their mobile applications, 61% believe that over the next five years, more than 60% of their clients will be using mobile applications at least once a month to access financial services (see Figure 17). ...more than 60% of their clients will be using mobile applications (at least once † …ates otes‹ Annua “etter‹ 215 a month) to access financial services

Global FinTech Report Page 32 Page 34

Global FinTech Report Page 32 Page 34