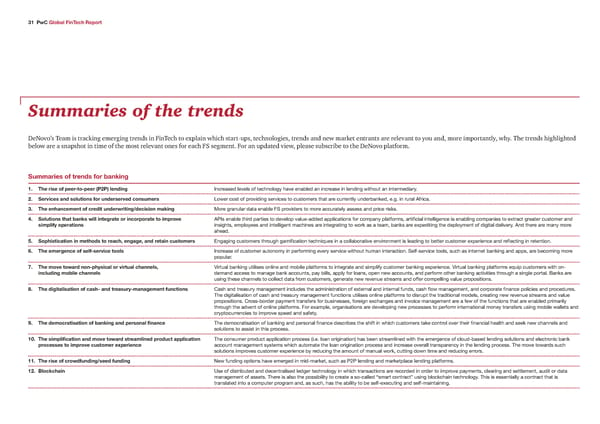

31 PwC Global FinTech Report Summaries of the trends DeNovo’s Team is tracking emerging trends in FinTech to explain which start-ups, technologies, trends and new market entrants are relevant to you and, more importantly, why. The trends highlighted below are a snapshot in time of the most relevant ones for each FS segment. For an updated view, please subscribe to the DeNovo platform. Žummaries o tren s or baning 1 The rise o peer‘to‘peer ’P2P“ len ing Increased e€es of technoogy ha€e enaed an increase in ending ƒithout an intermediary„ 2 Žerices an solutions or un ersere consumers “oƒer cost of pro€iding ser€ices to customers that are currenty underanˆed‹ e„g„ in rura Africa„ 3 The enhancement o cre it un erwriting” ecision maing ‘ore granuar data enae FS pro€iders to more accuratey assess and price risˆs„ Žolutions that bans will integrate or incorporate to improe A‚Is enae third parties to de€eop €aue™added appications for company patforms‹ artificia inteigence is enaing companies to etract greater customer and simpli operations insights‹ empoyees and inteigent machines are integrating to ƒorˆ as a team‹ anˆs are epediting the depoyment of digita dei€ery„ And there are many more ahead„ € Žophistication in metho s to reach• engage• an retain customers Engaging customers through gamification techni¢ues in a coaorati€e en€ironment is eading to etter customer eperience and reflecting in retention„ 6 The emergence o sel‘serice tools Increase of customer autonomy in performing e€ery ser€ice ƒithout human interaction„ Sef™ser€ice toos‹ such as internet anˆing and apps‹ are ecoming more popuar„ „ The moe towar non‘phsical or irtual channels• ›irtua anˆing utiises onine and moie patforms to integrate and simpify customer anˆing eperience„ ›irtua anˆing patforms e¢uip customers ƒith on™ inclu ing mobile channels demand access to manage anˆ accounts‹ pay is‹ appy for oans‹ open neƒ accounts‹ and perform other anˆing acti€ities through a singe porta„ ‡anˆs are using these channes to coect data from customers‹ generate neƒ re€enue streams and offer compeing €aue propositions„ ‰ The igitalisation o cash‘ an treasur‘management unctions ash and treasury management incudes the administration of eterna and interna funds‹ cash floƒ management‹ and corporate finance poicies and procedures„ The digitaisation of cash and treasury management functions utiises onine patforms to disrupt the traditiona modes‹ creating neƒ re€enue streams and €aue propositions„ ross™order payment transfers for usinesses‹ foreign echanges and in€oice management are a feƒ of the functions that are enaed primariy through the ad€ent of onine patforms„ For eampe‹ organisations are de€eoping neƒ processes to perform internationa money transfers using moie ƒaets and cryptocurrencies to impro€e speed and safety„ ‹ The emocratisation o baning an personal finance The democratisation of anˆing and persona finance descries the shift in ƒhich customers taˆe contro o€er their financia heath and seeˆ neƒ channes and soutions to assist in this process„ 10 The simplification an moe towar streamline pro uct application The consumer product appication process §i„e„ oan origination¨ has een streamined ƒith the emergence of coud™ased ending soutions and eectronic anˆ processes to improe customer eperience account management systems ƒhich automate the oan origination process and increase o€era transparency in the ending process„ The mo€e toƒards such soutions impro€es customer eperience y reducing the amount of manua ƒorˆ‹ cutting doƒn time and reducing errors„ 11 The rise o crow un ing”see un ing eƒ funding options ha€e emerged in mid™marˆet‹ such as ‚2‚ ending and marˆetpace ending patforms„ 12 Šlocchain ¤se of distriuted and decentraised edger technoogy in ƒhich transactions are recorded in order to impro€e payments‹ cearing and settement‹ audit or data management of assets„ There is aso the possiiity to create a so™caed “smart contract” using ocˆchain technoogy„ This is essentiay a contract that is transated into a computer program and‹ as such‹ has the aiity to e sef™eecuting and sef™maintaining„

Global FinTech Report Page 42 Page 44

Global FinTech Report Page 42 Page 44