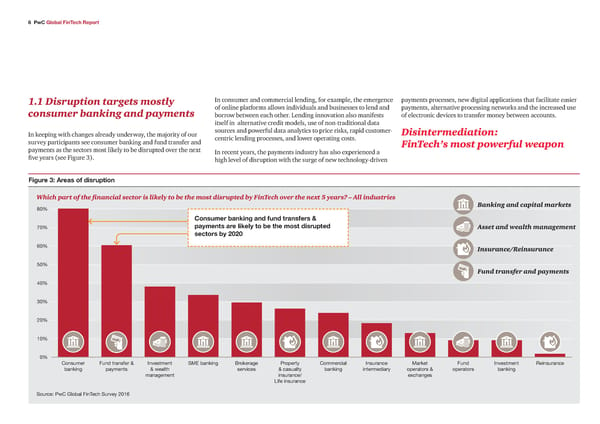

6 PwC Global FinTech Report 1.1 Disruption targets mostly In consumer and commercial lending, for example, the emergence payments processes, new digital applications that facilitate easier consumer banking and payments of online platforms allows individuals and businesses to lend and payments, alternative processing networks and the increased use borrow between each other. Lending innovation also manifests of electronic devices to transfer money between accounts. itself in alternative credit models, use of non-traditional data In keeping with changes already underway, the majority of our sources and powerful data analytics to price risks, rapid customer- Disintermediation: survey participants see consumer banking and fund transfer and centric lending processes, and lower operating costs. FinTech’s most powerful weapon payments as the sectors most likely to be disrupted over the next In recent years, the payments industry has also experienced a five years (see Figure 3). high level of disruption with the surge of new technology-driven Figure 3: ‚reas o isruption Which part of the financial sector is likely to be the most disrupted by FinTech over the next 5 years? – All industries •‰ Banking and capital markets Consumer baning an un transers ƒ –‰ paments are liel to be the most isrupte Asset and wealth management sectors b 2020 †‰ Insurance/Reinsurance 5‰ Fund transfer and payments 4‰ 3‰ 2‰ 1‰ ‰ onsumer Fund transfer Ž In€estment S‘E anˆing ‡roˆerage ‚roperty ommercia Insurance ‘arˆet Fund In€estment ”einsurance anˆing payments Ž ƒeath ser€ices Ž casuaty anˆing intermediary operators Ž operators anˆing management insurance’ echanges “ife insurance Source: ‚ƒ …oa FinTech Sur€ey 21†

Global FinTech Report Page 11 Page 13

Global FinTech Report Page 11 Page 13