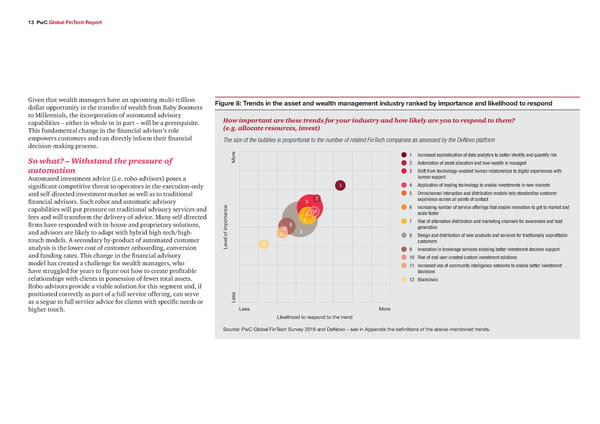

13 PwC Global FinTech Report Given that wealth managers have an upcoming multi-trillion- Figure ‰: Tren s in the asset an wealth management in ustr rane b importance an lielihoo to respon dollar opportunity in the transfer of wealth from Baby Boomers to Millennials, the incorporation of automated advisory How important are these trends for your industry and how likely are you to respond to them? capabilities – either in whole or in part – will be a prerequisite. (e.g. allocate resources, invest) This fundamental change in the financial advisor’s role empowers customers and can directly inform their financial The size of the bubbles is proportional to the number of related FinTech companies as assessed by the DeNovo platform decision-making process. e 1 Increased sophistication of data analytics to better identify and ‹uantify risk So what? – Withstand the pressure of ‘or 2 Automation of asset allocation and how wealth is managed automation Shift from technologyenabled human relationships to digital eperiences with Automated investment advice (i.e. robo-advisors) poses a human support significant competitive threat to operators in the execution-only 1 Application of leading technology to enable investments in new markets and self-directed investment market as well as to traditional Omnichannel interaction and distribution models help standardise customer financial advisors. Such robot and automatic advisory 2 eperience across all points of contact capabilities will put pressure on traditional advisory services and € Increasing number of service offerings that enable innovation to get to market and fees and will transform the delivery of advice. Many self-directed € scale faster ƒ ƒ ‰ise of alternative distribution and marketing channels for awareness and lead firms have responded with in-house and proprietary solutions, importance † generation and advisors are likely to adapt with hybrid high-tech/high- 1ˆ „ of 11 „ ‚esign and distribution of new products and services for traditionally unprofitable touch models. A secondary by-product of automated customer 12 customers analysis is the lower cost of customer onboarding, conversion “e€e † Innovation in brokerage services enabling better investment decision support and funding rates. This change in the financial advisory 1ˆ ‰ise of end usercreated custom investment solutions model has created a challenge for wealth managers, who 11 Increased use of community intelligence networks to enable better investment have struggled for years to figure out how to create profitable decisions relationships with clients in possession of fewer total assets. 12 ‡lockchain Robo-advisors provide a viable solution for this segment and, if positioned correctly as part of a full service offering, can serve as a segue to full service advice for clients with specific needs or “ess higher touch. “ess ‘ore “iˆeihood to respond to the trend Source: ‚ƒ …oa FinTech Sur€ey 21† and eo€o – see in Appendi the definitions of the ao€e™mentioned trends„

Global FinTech Report Page 19 Page 21

Global FinTech Report Page 19 Page 21